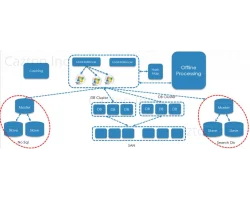

Cazton is composed of technical professionals with expertise gained all over the world and in all fields of the tech industry and we put this expertise to work for you. We offer professional services in the field of custom software development, consulting, training and recruiting. Cazton has expanded into a global company, servicing clients across the United States, Canada, Norway, Sweden, England, Germany, France, Netherlands, Belgium, Italy, Australia and India. We serve all industries, including banking & investment services, finance and mortgage; fintech, legal services, life sciences & healthcare, construction, chemical industries, hotel industries, transport & tourism, commerce, technology, media, e-commerce, telecom, airlines, logistics and supply chain. Learn more about our services below.

Work with world class consultants!

Our experts are able to quickly identify, predict, and satisfy our clients' current and future need.